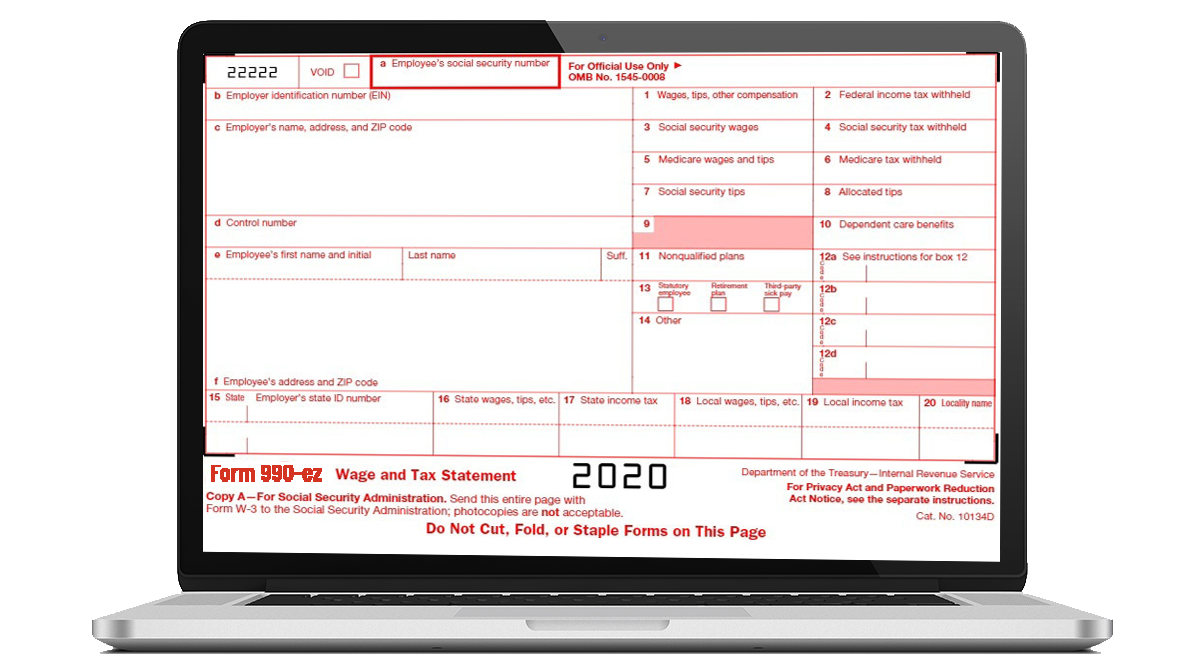

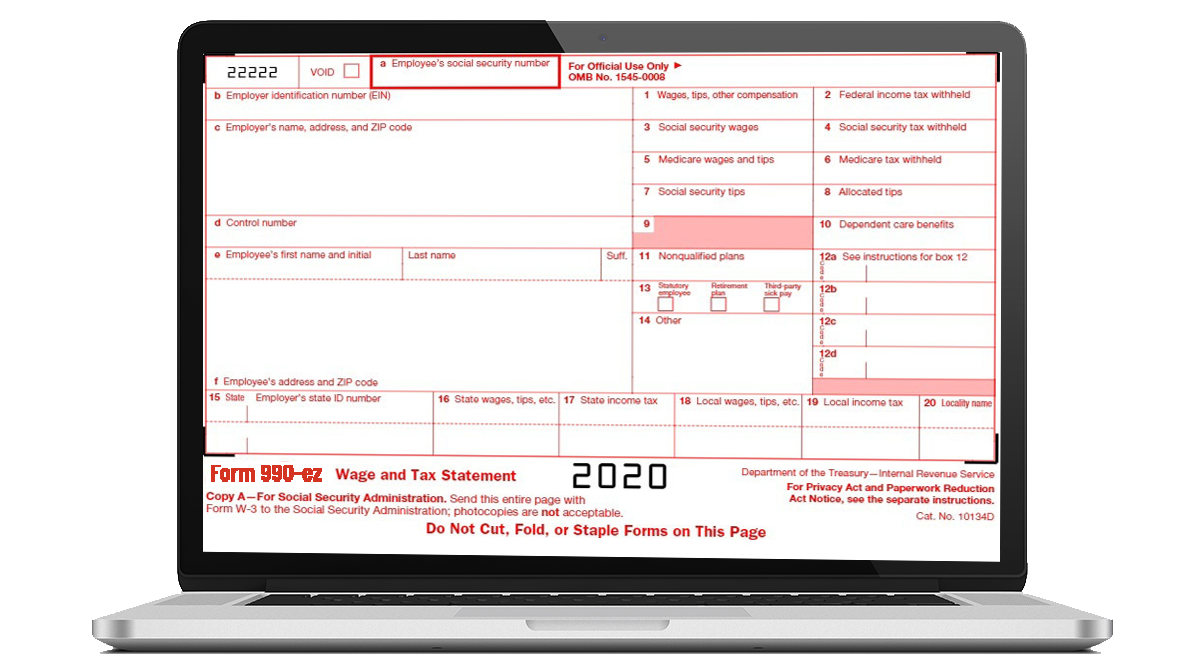

Information Required to File Form 990-EZ

Here is the information you will need to complete Form 990-EZ:

- Gross Income

- Total expenses incurred within the last year

- Disbursements within the year that are the reason the organizations is exempt

- Balance sheet showing assets, liabilities, and net worth

- Total contributions & gifts received during the year and the names and addresses of all substantial contributors

- Names and addresses of the foundation's managers and highly-compensated employees

- Respective amounts of the taxes imposed on the organization or any manager of the organization

WHO MUST FILE FORM 990-EZ?

FORM 990-EZ SCHEDULES

- Compensation and other payments made during the year

- Lobbying expenditures and nontaxable amounts

- Direct or indirect transfers and relationships with other organizations of the same type

- Amounts of reimbursements paid by the organization during the taxable year for any taxes imposed

- Information on any excess benefit transaction

- Information on any disqualified persons

- Information on disaster relief activities

Who is Not Required to File Form 990-EZ?

Here are the different types of organizations that don't need to file Form 990-EZ:

- An organization that is not tax exempt

- A tax exempt organization that has $50,000 or less in gross receipts

- A tax exempt organization that has more than $200,000 in gross receipts and has $500,000 or more in total assets.

- Churches, associations of churches, and integrated auxiliaries of churches

Reporting the 990-EZ to States

Reporting your organization to your state could require the Form 990-EZ. Some states will require that you file their version of this form, some states accept the 990-EZ, some states do not require anything at all. To be sure of the form you need to file please call your state's Department of Revenue or Taxation to clarify your filing requirements.

Group returns

Group returns may be filed when a parent or central organization can

file a Form 990 for two or more subordinate or local organizations that are:

- Affiliated with the central organization at the time its tax year ends

- Subject to the central organization's general supervision or control

- Exempt from tax under a group exemption letter that is still in effect

- Use the same tax year as the central organization

.png)